Introduction: Understanding the Basics

What is a business trust? If you’re looking at this question in 2025, you’re not by yourself. Lots of new business owners, real estate-managing families, and investors are seeking unique solutions for protecting assets, minimizing tax liabilities, and planning. One of them that’s attracting more attention is the business trust. But what is it?

A business trust is a legal arrangement in which a trustee operates property or a business for other beneficiaries. Consider it a combination of business and estate planning mechanisms. It’s less popular than an LLC or corporation, but it’s increasing in popularity for individuals who desire more control, privacy, or planning over the long term in their operations.

In this guide, we’ll break down what a business trust is, how it works, its pros and cons, who should use it, and how to create one step by step. We’ll also cover real-life examples, legal tips, tax basics, and answer the most common questions people ask.

What Exactly Is a Business Trust?

A business trust, or “Massachusetts trust” in a few states, is a legal arrangement in which a person (the trustee) operates a business or handles assets for another person (the beneficiaries). It’s an instrument of law, commonly employed in estate planning or investment planning, but it can also serve as a business organization.

A business trust, or “Massachusetts trust” in a few states, is a legal arrangement in which a person (the trustee) operates a business or handles assets for another person (the beneficiaries). It’s an instrument of law, commonly employed in estate planning or investment planning, but it can also serve as a business organization.

Unlike a corporation that shareholders own or an LLC owned by members, a business trust is based on a trust agreement. This agreement defines how the trust will run, how profits will be distributed, and what powers the trustee has.

So, if you’re still wondering “what is a business trust,” the simple answer is: It’s a legal entity that operates a business under a trust structure, offering a unique mix of control, flexibility, and privacy.

Why Are People Choosing Business Trusts in 2025?

In today’s world, privacy, asset protection, and long-term planning are more important than ever. Here’s why more people are choosing business trusts:

- Less Public Disclosure: Business trusts don’t require the same level of public filing as corporations.

- Better Asset Protection: Assets in a trust may be harder for creditors to reach.

- More Control: You can write detailed rules about how the trust is managed.

- Long-Term Planning: They work well for family businesses or real estate passed down through generations.

- Tax Efficiency: Depending on how it’s set up, a trust can offer some tax benefits.

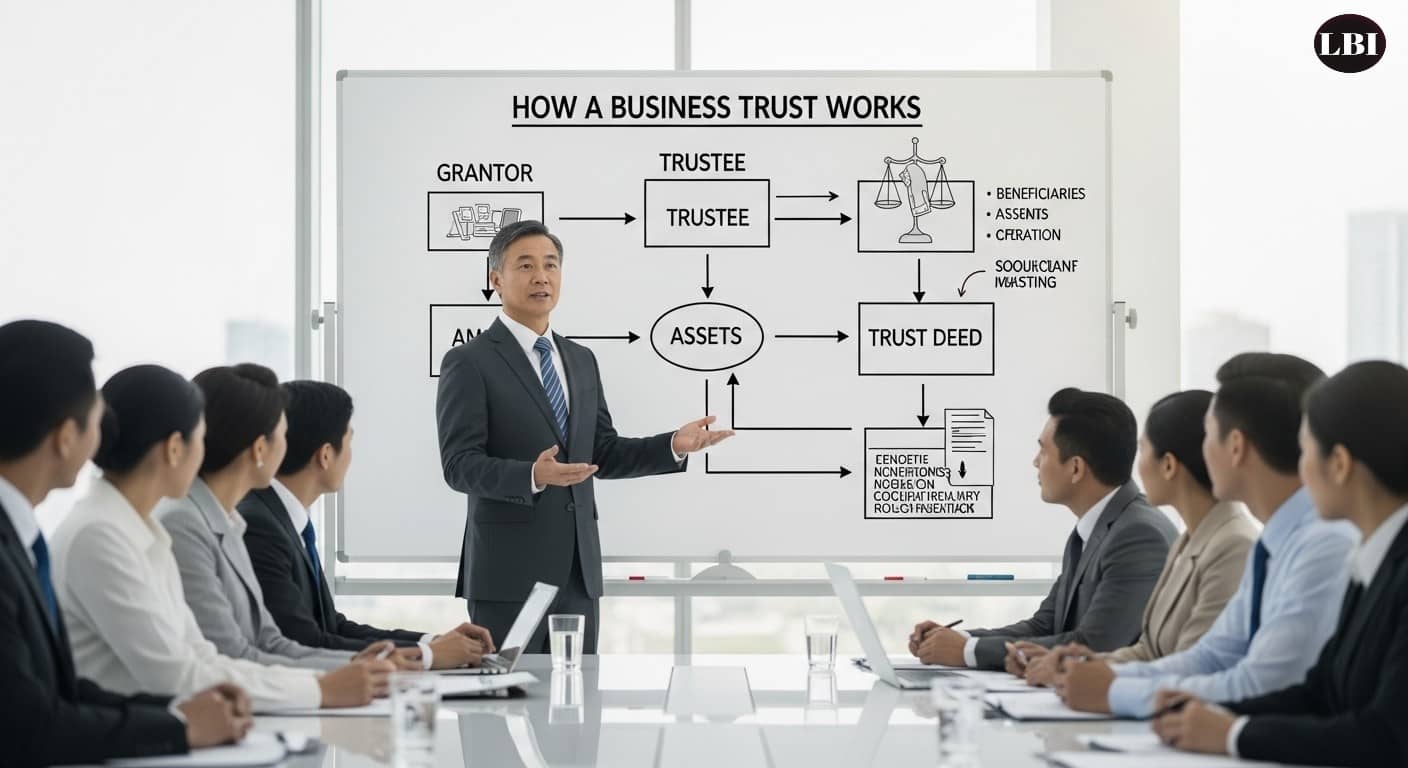

How a Business Trust Works

Let’s clarify with an example. John has some rental properties. Rather than hold them in his name or an LLC, he forms a business trust. He makes himself the trustee and designates his two children as beneficiaries. The properties are now owned legally by the trust, and profits accrue to the kids according to the trust agreement.

Let’s clarify with an example. John has some rental properties. Rather than hold them in his name or an LLC, he forms a business trust. He makes himself the trustee and designates his two children as beneficiaries. The properties are now owned legally by the trust, and profits accrue to the kids according to the trust agreement.

That’s the basic structure:

- Trustee: A Person who manages the trust and its assets.

- Beneficiaries: People who receive profits or benefits.

- Trust Property: Assets or business operations controlled by the trust.

- Trust Agreement: Legal rules that define how the trust functions.

The trustee must act in the best interest of the beneficiaries. They run the business, manage assets, pay bills, collect income, and report to the beneficiaries.

Types of Business Trusts

There are two common types:

1. Statutory Business Trust

- Created under state laws.

- Recognized as a separate legal entity.

- Offers limited liability to trustees and beneficiaries.

- Common for mutual funds and investment firms.

2. Common Law Business Trust

- Based on traditional trust principles, not specific laws.

- Usually offers less liability protection.

- More flexible, but not as widely recognized.

If you want clear rules and protection, the statutory trust is usually the better route in 2025.

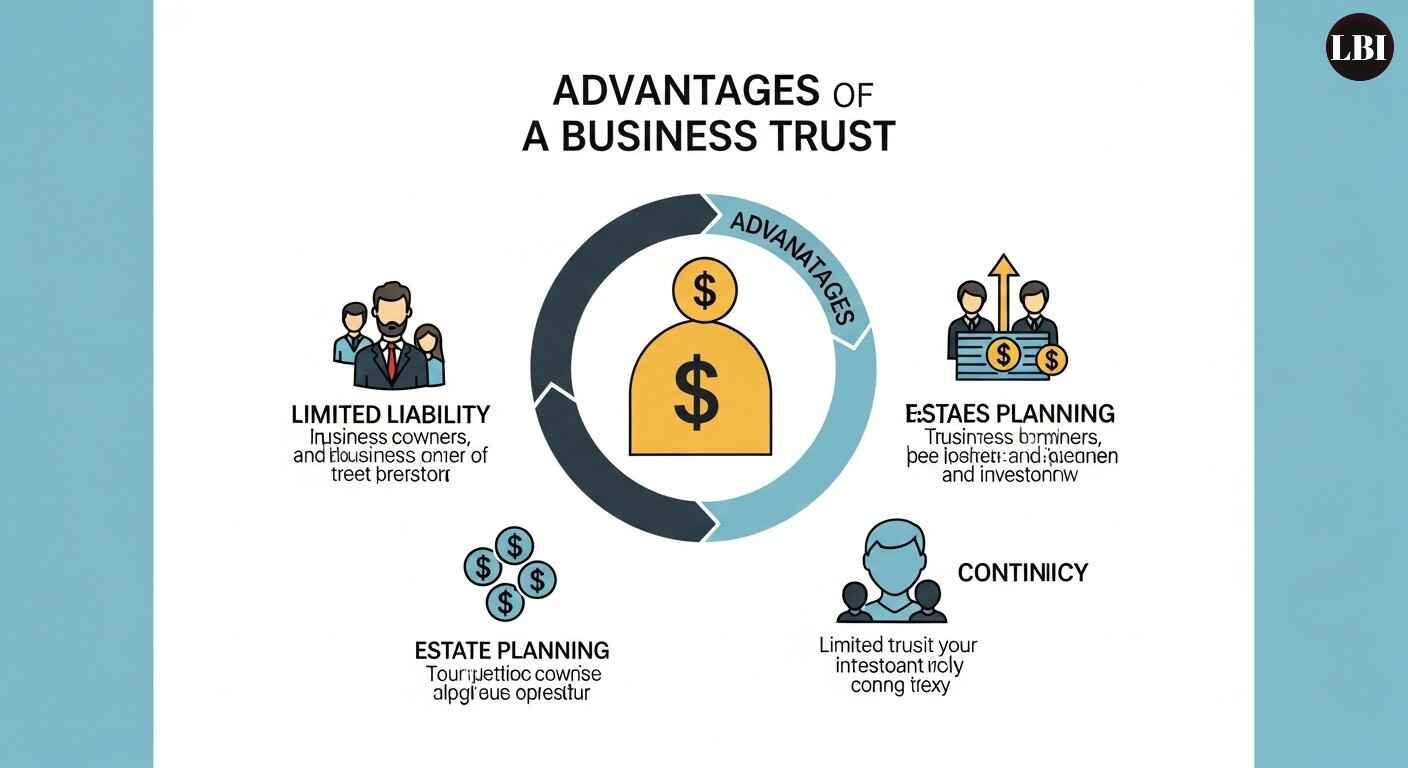

Advantages of a Business Trust

Let’s explore why someone would go through the effort of setting one up.

Let’s explore why someone would go through the effort of setting one up.

1. Privacy

Business trusts usually don’t require public filing of ownership details. This means your name, finances, and personal info stay out of public databases.

2. Asset Protection

Since the trust owns the business or property, not your creditors, they have a harder time claiming those assets. This is useful for high-net-worth individuals and families.

3. Estate Planning

You can pass down assets smoothly without going through probate. The trust continues to operate after your death, with clear instructions for your heirs.

4. Control and Flexibility

Unlike a will, a business trust lets you set strict rules for how assets are managed, when profits are distributed, and what beneficiaries can or can’t do.

5. Tax Efficiency

In many cases, profits can be passed directly to beneficiaries, avoiding corporate-level taxes. But it must be set up correctly to avoid IRS issues.

Disadvantages of a Business Trust

Despite the benefits, business trusts aren’t for everyone.

Despite the benefits, business trusts aren’t for everyone.

1. Complex Setup

It takes time, legal expertise, and money to create the trust agreement and make sure it complies with state laws.

2. Limited Recognition

Some states and business partners aren’t as familiar with business trusts, which can make legal or banking relationships more complicated.

3. Higher Costs

You’ll need legal help to set up and maintain a trust. These costs can be higher than setting up an LLC.

4. Tax Confusion

If not managed properly, you could end up with unexpected tax bills. You’ll need a CPA or tax attorney familiar with trust law.

Business Trust vs. LLC vs. Corporation

Here’s a quick comparison:

| Feature | Business Trust | LLC | Corporation |

| Ownership | Beneficiaries | Members | Shareholders |

| Management | Trustees | Members/Managers | Directors/Officers |

| Liability Protection | Yes (varies) | Yes | Yes |

| Taxation | Flexible (pass-through or trust taxed) | Pass-through by default | Double taxation unless S-corp |

| Privacy | High | Medium | Low |

| Setup Cost | High | Low to Medium | Medium to High |

| Public Disclosure | Minimal | Required in some states | Required |

If privacy and estate planning are top priorities, a business trust wins. But for simpler business operations, an LLC or corporation may be easier.

Who Should Use a Business Trust?

A business trust isn’t for every small business owner, but it can be ideal in certain situations.

A business trust isn’t for every small business owner, but it can be ideal in certain situations.

You should consider one if:

- You own income-producing real estate.

- You want to pass down a family business without selling it.

- You’re planning for wealth transfer and legacy building.

- You have multiple beneficiaries you wish to manage income for.

- You want more privacy and asset control.

If your goal is long-term planning with fewer outside eyes on your business, this structure makes sense.

Steps to Create a Business Trust

Here’s how to set one up the right way in 2025:

1. Define Your Purpose

Decide why you’re creating the trust. Is it for holding rental property? Running a business? Planning your estate?

2. Choose Trustees and Beneficiaries

Pick a trustworthy person or group to act as trustees. Then decide who will benefit financially.

3. Draft the Trust Agreement

This is the legal heart of the trust. It spells out:

- How the trust operates

- What powers does the trustee have

- How profits are distributed

- What happens if someone dies or the business changes

Work with an experienced lawyer. A weak trust agreement can cause problems later.

4. Fund the Trust

Transfer property or business ownership to the trust. Deeds, business records, or financial accounts will likely need to be revised with the trust as the new owner.

5. Get a Tax ID (EIN)

The trust is a legal entity and will require its tax ID. This is accomplished through the IRS and is typically easy.

6. Follow Ongoing Rules

Maintain records, pay taxes, and keep close to the trust agreement. Trustees are always required to work in the interest of the beneficiaries.

Real-Life Examples of Business Trusts

Example 1: Real Estate Family Trust

Example 1: Real Estate Family Trust

Michael owns four apartment buildings. He sets up a business trust to manage them. His daughter becomes a trustee, and his grandchildren are named beneficiaries. Profits go to the grandkids’ college funds, and the trust runs smoothly even after Michael’s death.

Example 2: Investment Group

A group of five investors creates a business trust to hold their combined capital. The trustee handles all investment decisions, and profits are split based on each investor’s contribution.

Example 3: Succession Planning

A bakery owner wants to retire but doesn’t want to sell the shop. He sets up a business trust, naming his long-time manager as trustee and his children as beneficiaries. The bakery continues operating, and the profits help fund his retirement.

Legal and Tax Considerations in 2025

In 2025, IRS rules still allow flexibility in how trusts are taxed, but the details can get complicated.

- Revocable vs. Irrevocable: A revocable trust can be changed; an irrevocable one cannot. Most business trusts are irrevocable for tax protection.

- Pass-Through Taxation: Profits go straight to beneficiaries (who pay taxes individually).

- Trust Tax Rates: If income stays in the trust, it can be taxed at higher rates.

- State Rules: Some states tax trusts more heavily. Always check local laws.

You’ll need both a lawyer and a tax advisor to avoid costly mistakes.

2025 Trends in Business Trusts

As we move deeper into the decade, here are trends to watch:

As we move deeper into the decade, here are trends to watch:

- Digital Trust Formation: More services allow trusts to be set up online securely.

- Hybrid Structures: Some businesses use LLCs within trusts to get the best of both worlds.

- Crypto and Digital Asset Trusts: Investors are using trusts to hold Bitcoin, NFTs, and other digital assets.

- Global Use: Families are creating international business trusts for asset protection and tax planning.

Conclusion

So, to answer the main question, what is a business trust? It’s a flexible, private, and strategic way to run a business or manage assets through a legal agreement, rather than through traditional corporate ownership.

In 2025, as more people look for ways to secure their wealth, protect their privacy, and plan for the future, business trusts are becoming a more intelligent, more respected choice. While they aren’t right for everyone, they can be powerful when used correctly.

If you think this structure may fit your needs, speak with a qualified attorney and financial planner to start the process the right way.

Frequently Asked Questions (FAQs)

1. What is a business trust in plain words?

It’s a legal setup where someone manages a business or property for others, who get the profits.

2. Is a business trust better than an LLC?

It depends. Trusts offer more privacy and control, while LLCs are easier to set up and manage.

3. Can I set up a business trust on my own?

You can, but it’s risky. You should work with a lawyer to avoid legal or tax issues.

4. Do I pay taxes with a business trust?

Yes, but how you pay depends on the structure. Income might be taxed at the trust level or passed to beneficiaries.

5. What kinds of businesses can use a trust?

Any real estate, investments, family-owned businesses, and more.